Now that Rishi Sunak has confirmed in his budget announcement that a range of UK lenders will be offering mortgages with just a 5% deposit from April 2021, you might be wondering what you need to do now to prepare for a mortgage application.

This short guide includes what you need to know about how you can find a lender and get accepted for a 95% LTV mortgage.

Rather speak on the phone than read our guide? No problem, we have experts ready to help.

What is a 95% mortgage?

A mortgage that has a loan-to-value rate of 95% requires just a 5% deposit.

If the borrower meets their chosen lender’s mortgage criteria, they can borrow up to 95% of the value of the property they would like to buy.

Under a 5% deposit mortgage agreement, a property with a market value of £200,000 would require £10,000 as an upfront payment to the lender.

In return, the lender would provide a loan of £190,000 (95%) over an agreed period of time with the added cost of interest.

What lenders provide 5% deposit mortgages in the UK?

Lenders had previously retracted their low deposit mortgage products but April 2021 could see an increasing variety of options for buyers.

Since Rishi Sunak’s budget announcement, some leading lenders have provided details about new, 5 year fixed-rate mortgages for borrowers with 5% deposits and other lenders have increased the variety of products they offer to first-time buyers with 10% mortgage deposits too.

2021 could be a promising year for low-deposit buyers, whether first-timers or not. The size of a deposit was an ever-increasing hurdle whereas now, there are options available that could be achievable for many with time and good mortgage advice.

How much is a 5% deposit for a house?

The UK House Price Index found that the average property price for a New Build house in the UK was £323,994 as of September 2020, so a buyer hoping to get a 5% mortgage would need £16,199.70.

It’s important to bear in mind that the price of a New Build property varies greatly between regions and usually, properties in sought-after areas can demand higher prices.

The 5% deposit scheme is also available for mortgages for older properties too, which can typically demand lower prices in comparison to newly built homes. The UK House Price Index also found that the average price for an existing resold property was £256,239.

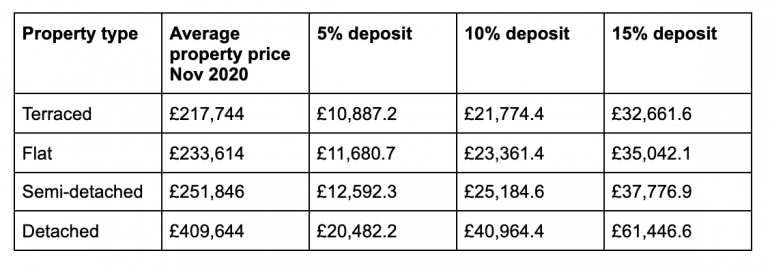

The type of property you’re purchasing can also affect the average market value as shown below, so sometimes a smaller amount of savings may be sufficient enough for a 5% deposit.

Different lenders have different criteria and the amount of deposit that you’ll need for a house purchase will depend on your own circumstances, as well as the type of property you’re planning to buy.

The quickest way to find out how much you’ll need and whether you’ll be eligible to apply for a 95% home loan, is to speak to a mortgage broker.

Are 5% deposit mortgages expensive?

Interest rates can be charged at a higher rate for loans that are categorised as high-risk and typically, loans for such a large proportion of a properties’ market value can be risky for the lender who is at risk of great loss if the borrower fails to keep up with their repayments.

The UK government has said that they’ll “shoulder some of the risks associated with 95% loan-to-value mortgages” which his why a wider range of banks and lenders are now providing additional mortgage deals, however, interest rates may be significantly higher in comparison to loans with a lower LTV that require higher deposits.

In short, having a bigger deposit can help you get a better interest rate and that matters because it’ll affect how much your mortgage payments are each month.

Calculate your mortgage repayments with a 5% deposit using our mortgage calculator if you’re in a hurry but preferably, the best way to get a quote that is representative of your circumstances is to get in touch with a mortgage broker.

Preparing for a 5% deposit mortgage application

2021 could be the year that sees many get onto the property ladder. Keen to be one of them? Read our tips below:

Get your paperwork in order to prove your income and ID

You’ll need:

ID documents (usually a passport or driving licence)

Proof of address (e.g. utility bills or credit card bills)

Proof of deposit. Most lenders ask for three months’ bank statements for your savings account

Proof of income. Most lenders will ask for three months' bank statements for your current account as well as three months’ payslips

Some lenders, though not all, accept income from bonuses and commission too

If you’re self-employed, most lenders will ask for your last two-three years' accounts or tax returns

Don’t send your paperwork in drips and drabs - being organised can be helpful here so set aside some time to find the documents and paperwork you need and send them to your chosen mortgage broker.

With your permission, they can use the information you’ve provided to begin the process of checking your eligibility for 95% LTV mortgages.

Manage your credit score

Lenders look at credit scores to determine if you’re likely to default (not pay) your mortgage, as well as assess your affordability overall and the majority will not loan 95% of a properties’ value on a mortgage if there are concerns about either.

The good news is that you don’t necessarily need a perfect credit score to get a mortgage and even people with bad credit may be able to get approved for a low deposit mortgage with the right advice.

You can learn more on how to improve your credit score in our Experian boost guide or alternatively, ask a broker for their advice on how you can repair your credit history to get a mortgage.

Don’t apply for finance or credit

Applying for credit in the run-up to applying for a mortgage can be a quick way to show lenders that you’re in need of money, so multiple applications of credit can result in some lenders rejecting applicants.

Furthermore, if you’re refused credit by any of the lenders you have previously applied to, that will show up on your credit report and future lenders can use that information to make their decisions.

It can also be a good idea to stay out of any overdrafts, limit the usage of any credit cards and avoid high-risk borrowings such as payday loans or buy-now-pay-later schemes for retail purchases.

Always repay any current finance or debt re-payment agreements on time and in full and if any applications for credit have to be made, calculate your affordability with a financial advisor.

Contact a broker about getting a mortgage with a 5% deposit

We have mortgage brokers that specialise in low-deposit mortgages for people with a low credit score, as well as experts for New Builds, buy-to-lets, remortgages and even mortgages for NHS workers.

We help all sorts of people successfully secure mortgages every day.

You can message an expert confidentially using our enquiry form or stop by the office for an informal chat if you’d prefer. We’re real people that enjoy helping others get onto the property ladder.